Raising funds for your project can be a complex task. It often involves crafting a compelling narrative that emphasizes the impact of your project. There are numerous channels to explore, including grants to private sponsorships.

- Research potential funders that align with your project's goals and mission.

- Network with industry professionals who may be able to support your venture

- Develop a persuasive proposal that articulates the value proposition of your project.

Resilience is key when seeking funds. Don't be dejected by initial obstacles. Continue to strengthen your plan and investigate new possibilities.

Websites to Fund Projects

Nowadays, it's a piece of cake to raise funds for your projects. With the boom of digital tools, everyone can leverage the power of collective funding. Crowdfunding websites act as connectors between project founders and potential investors who are passionate about their goals.

Startups to groundbreaking campaigns, crowdfunding offers a unique opportunity for securing resources.

- Websites such as Kickstarter, Indiegogo, and GoFundMe present numerous choices in categories of projects

- They enable creators to pitch their projects with a larger community

- Funded initiatives often present impactful visions

Raise Funds Websites For Small Business

Starting a small business can be challenging. One fantastic approach to raise money is through crowdfunding. These online communities connect entrepreneurs with investors who are willing to provide funds.

Popular platforms{like Kickstarter, Indiegogo and GoFundMe, offer a selection of funding options and resources to help you get started. Before you jump in, it's important to carefully plan and create a compelling pitch that will appeal to investors.

- Here are some tipsfor creating a successful crowdfunding campaign:

- Set clear goals and objectives

- Tell a captivating story about your business

- Offer incentives for different funding levels

- Promote your campaign on social media and other channels

With dedication and a well-crafted proposal, you can use funding platforms to fuel your business growth.

Trending Crowdfunding Websites

There's a plethora of crowdfunding platforms out there to help you fund your next big idea. Some of the most popular include Kickstarter, which is great for creative projects and gadgets. Indiegogo offers more choices with different campaign types, including rewards and equity funding. GoFundMe is a go-to for personal causes and emergencies. , On the other hand, Patreon allows creators to build a dedicated following through recurring donations. These are just a few of the many fantastic crowdfunding websites out there waiting to help you bring your dreams to life.

- Kickstarter

International Crowdfunding Websites

The rise of the internet has catalyzed a surge in crowdfunding, with platforms sprouting across the globe. International crowdfunding websites present a abundance of opportunities for individuals to attract funding from a global pool of supporters.

These platforms often target on specific niches, such as technology, art, or social enterprise. They harness different funding models, including all-or-nothing, flexible funding, and rewards-based donations.

Discovering the world of international crowdfunding can be a fruitful experience. It's essential to meticulously research different platforms, grasp their conditions, and choose one that aligns your needs.

Top Crowdfunding Websites kickstart

Looking to raise your next big idea? The world of crowdfunding has exploded in popularity, providing a platform for entrepreneurs, artists, and passionate folks to connect with backers who share their vision. Some of the most popular crowdfunding websites include Kickstarter, Indiegogo, Patreon, and GoFundMe. Each platform focuses on different types of projects, so it's important to pick the one that best suits your needs. Whether you're looking for funding for a film project, a new product launch, or simply need financial assistance during a difficult time, there's a crowdfunding website out there to help.

- Kickstarter: Known for its focus on creative projects, Kickstarter encourages innovative ideas in categories like film, art, design, and technology.

- Indiegogo: This platform offers more flexibility, facilitating a wider range of projects, including business ventures and social causes.

- Patreon: Ideal for recurring support, Patreon lets creators develop a community of monthly subscribers who contribute to their ongoing work.

- GoFundMe: Designed for personal fundraising campaigns, GoFundMe is often used for medical expenses, emergency situations, and charitable causes.

Regulation A+ Offering: Hype or Reality? Fundraising - Crowdfund Insider

Regulation A+ offerings have captured the attention of both investors and entrepreneurs alike. Offering the potential for significant Returns, these offerings allow companies to raise capital from a wider pool of investors than traditional methods. However, is Regulation A+ truly all it's {Crackedsounded or is it simply hype? Some argue that the process can be complex and Demanding, while others believe that the Advantages outweigh the Drawbacks.

- One of the key Allure of Regulation A+ is its ability to Enable companies to access a Wider range of investors.

- Furthermore, Regulation A+ offerings can be a more Cost-effective way for companies to raise capital compared to traditional methods.

- However, it's important to Conduct due diligence and understand the Challenges associated with any investment, including Regulation A+ offerings.

The future of Regulation A+ remains to be seen. As Awareness continues to grow, it will be interesting to see how this funding Approach evolves and Shapes the investment landscape.

Reg A+

Seeking to raise capital for businesses, many entrepreneurs are turning to Reg A+ as a powerful alternative. This method allows publicly traded companies to secure capital from the wider market, presenting a unique opportunity for both {companies{ and investors. This flexible system website encourages economic development by streamlining access to investment opportunities. A few key features of Regulation A+ include a efficient registration procedure, higher investor protection, and the ability for companies to raise significant amounts of capital.

Outline Title IV Regulation A+ for you | Manhattan Street Capital

Title IV Regulation A+ is a capital raising mechanism that allows companies to raise capital from the public investors. Under this rule, businesses can sell securities virtually to a broader range of participants. Manhattan Street Capital is a platform that specializes in helping companies navigate Title IV Regulation A+. They offer guidance throughout the journey, from finalizing the offering documents to promoting about the investment opportunity.

- Additionally, Manhattan Street Capital provides investors with a reliable platform to explore investment opportunities and participate in Regulation A+ offerings.

- Ultimately, Title IV Regulation A+ presents a unique opportunity for companies to attract capital from a wider pool of investors. Manhattan Street Capital plays a significant function in streamlining this process, making it more reachable for both companies and investors.

Empowering Expansion with Reg A+

The transformative Reg A+ solution is revolutionizing the way businesses secure funding. This versatile regulatory framework provides a powerful opportunity for companies to leverage the public markets, propelling growth and achieving ambitious objectives. With its streamlined process, Reg A+ enables businesses of various scales to catalyze their future potential in a accountable manner.

- Advantages include:

- Affordability

- Efficient workflow

- Wider investor base

Define A Reg - We've Got All The Types

Alright, listen up. You want to know about regs, because they're everywhere. We're talking about regulations, the {kindestablishing everything from your phone.

You can't escape them, and that's okay. We've got all the regs cataloged, so you don't have to hunt for them. Just tell us what you require, and we'll point you in the right direction.

- Some people think regs are a pain in the neck.

- However

- Just relax; we're here to help you navigatethese guidelines.

Capitalizing on Opportunity: What Startups Need to Know About Regulation A+

Regulation A+, a funding instrument, presents a unique avenue for startups seeking to raise investment. This mechanism allows companies to sell securities to the wider market with reduced regulatory burden compared to traditional IPOs. However, navigating the complexities of Regulation A+ demands a thorough understanding of its terms.

A well-structured initiative under Regulation A+ may provide startups with several benefits, including increased exposure, access to a broader group, and the ability to raise substantial capital. Startups considering Regulation A+ should thoroughly analyze their business model and estimates to determine if this option aligns with their aspirations. It is also critical for startups to consult with experienced legal professionals to ensure a seamless and successful Regulation A+ offering.

Regulation A+ Works with Equity Crowdfunding

Equity crowdfunding represents a popular avenue for startups to raise capital. , Nevertheless accessing traditional funding sources can be challenging. This is where Regulation A+, a securities law , comes into play. It provides a streamlined system for companies to offer and sell securities publicly.

- Under Regulation A+, companies can raise up to $75 million over a period of time by selling shares directly to investors, expanding their base of traditional venture capitalists and angel investors.

- , Moreover, Regulation A+ streamlines the registration process with the SEC, reducing costs and smaller businesses to tap into public markets.

By leveragingcrowdfunding sites and adhering to Regulation A+ guidelines, startups can successfully raise capital, strengthening their financial foundation for growth.

Regulation A+ FundAthena

FundAthena is a investment group leveraging the power of Regulation A+ to offer investors simplified access to emerging investment strategies. Through a comprehensive online system, FundAthena aims to democratize capital formation by connecting accredited investors with innovative businesses across diverse sectors.

Their goal is to facilitate growth and innovation by providing a bridge between investors seeking smart capital allocation and companies in need of funding for their projects. FundAthena's focus to transparency throughout the investment process fosters a collaborative relationship between investors and the companies they support.

Special Purpose Acquisition Companies

A blank-check company, also known as a special purpose acquisition corporation, raises capital through an initial public offering with the primary goal of acquiring an existing private company. These companies launch without a concrete acquisition strategy. The capital obtained then used to purchase a suitable target company, effectively taking it public.

- Hopeful investors in blank-check companies anticipate the management team will identify and acquire a profitable company, resulting in substantial profits for investors.

- However, SPACs have faced criticism for, with some arguing that they can be susceptible to market volatility.

Colonial Stock Securities Regulation

The establishment of governing frameworks for stock securities in the colonial period was a challenging process. Driven by the expansion of business, colonial legislatures undertook to tackle concerns regarding market integrity in the new securities market. Despite scarcity of resources and knowledge, these early initiatives laid the groundwork for future developments in securities regulation. Significant among these frameworks was the creation of regulatory bodies tasked with regulating stock markets. These organizations often worked within a framework that balanced the need for market stability with the intention to foster business development.

Lookie Here! A New Ride

We've been looking for a bit, and finally, we found it. The team put together this awesome machine. It's got all the bells and whistles. We can't wait to get behind the wheel.

- Get a glimpse of this beauty

- {We'll post more details soon|More info coming soon.

Understanding Title IV Reg A+ - Crowdfunder Blog

Are you seeking to acquire capital for your business? Then Title IV Reg A+ could be precisely what you need. Our new infographic dives into the details of Title IV Reg A+, highlighting its advantages and how it can impact your funding journey.

- Discover the requirements of Title IV Reg A+

- Grasp the benefits for both investors and companies

- Investigate real-world examples of Title IV Reg A+ campaigns

Don't overlooking this invaluable resource for your next funding project. Click the infographic now and launch your journey towards successful Title IV Reg A+ campaign!

Regulation A Plus - Securex Filings LLC

Securex Filings LLC is a leading firm that assists companies in navigating the challenges of a Regulation A+ securities registration. As an experienced qualified offering specialist, Securex Filings LLC offers a comprehensive range of solutions to companies throughout the entire process.

- Their services include drafting and submitting the necessary forms with the Securities and Exchange Commission (SEC), conducting due diligence, guiding investor communications, and providing ongoing support.

- Securex Filings’ team of specialists has in-depth knowledge of the Regulation A+ regulations, and they are committed guiding issuers fulfill their securities offerings.

If your company is exploring a Regulation A+ offering, Securex Filings LLC can serve as your reliable advisor.

Explore Crowdfunding Opportunities on crowdfund.co with ease

Crowdfund.co is a dynamic online hub connecting passionate entrepreneurs to a vast network of investors. Whether you're seeking to fund your next big venture or eager to support innovative initiatives, crowdfund.co offers a wide range of opportunities to browse. With its user-friendly interface, powerful filtering tools, and detailed project summaries, you can quickly navigate the platform and locate the perfect fit for your interests.

- Find a variety of compelling projects in fields like technology, arts, and social impact

- Engage with entrepreneurs and investors with similar keen beliefs

- Drive innovation and make a contribution to the world through crowdfunding

Participate in the crowdfund.co community today and embrace the power of collective investment.

Fundrise's Reg A+ Offering

With the recent expansion of the real estate market, investors are seeking new avenues to engage themselves. Fundrise has emerged to meet this demand with its innovative Reg A+ offering. This allows individuals to invest commercial real estate projects with a relatively minimal .

- Fundrise's Reg A+ offering provides the ability for even smaller investors to participate in traditionally exclusive real estate opportunities.

- Furthermore, the Fundrise Reg A+ platform is structured to be clear and accessible, leading to a more fair investment process.

- Nevertheless, it is essential for investors to conduct their own research before participating in any investment venture.

Through a thorough understanding of|With careful consideration of the Fundrise Reg A+ offering's details, investors can make informed decisions about whether it is the suitable investment for them.

A Securities and Exchange Commission

The Securities and Exchange Authority (SEC) is an essential regulatory body tasked with protecting shareholders and maintaining the integrity of the financial markets. Founded in 1934, the SEC has broad jurisdiction over a extensive range of financial activities, such as trading of securities, company disclosures, and regulatory measures.

- Furthermore, the SEC sets regulations for financial reporting and transparency in the markets.

- Its objective is to promote fair and orderly markets, offer investors with reliable data, and stop unethical activities.

Crowdfunding Regulation A+ Title IV

Equity crowdfunding under Regulation A+ has emerged as a a method for companies to attract investment from the public. This framework allows businesses to sell equity interests to non-accredited individuals in exchange for financial support.

One key advantage of Title IV Reg A+ crowdfunding is that it expand the potential pool of funding. Companies can harness this opportunity to build awareness and attract attention from the general public.

- Furthermore, Title IV Reg A+ crowdfunding provides the ability to lower costs associated with traditional funding methods.

- On the other hand, it's important for companies to meticulously assess the legislative framework associated with this financing method.

Testing the Waters Crowdfunding for Masses StreetShares

StreetShares is a crowdfunding platform that allows small businesses to raise capital from the public. The company has recently announced a new initiative to test the waters of mass crowdfunding, aiming to bring in more investors and provide funding opportunities for even smaller ventures. This move comes at a time when traditional financing options are increasingly difficult to access for small businesses. StreetShares believes that crowdfunding can offer a viable alternative, allowing businesses to connect directly with potential investors and raise the resources they need to grow.

- The Company is hoping that this initiative will be successful in bringing more capital to small businesses and expanding its own reach.{

- Individuals are increasingly interested in supporting small businesses, and crowdfunding offers a way to do so directly.

Whether this new approach will be successful remains to be seen, but it is certainly an interesting development in the world of small business financing. It will be important to see how StreetShares fares as it navigates the challenges of mass crowdfunding.

Successful Fundraising Using Regulation A+ SEC

Regulation A+ provides a unique pathway for companies to raise capital. This tool allows businesses to solicit investments from the wider population while offering visibility through comprehensive disclosures. By exploiting Regulation A+, companies can obtain the resources they require to flourish, initiate new ventures, or strengthen their existing infrastructure.

- Regulation A+ simplifies the fundraising process for companies, minimizing regulatory obstacles.

- In addition to, Regulation A+ enables companies to foster a broader backer base, fueling sustainable development.

- Ultimately, Regulation A+ offers a powerful method for companies to attain the funds they need to thrive in today's competitive market.

Equity Network

EquityNet is a/serves as/provides an online platform/marketplace/network connecting/matching/bridging investors and entrepreneurs. Through/Via/On its site/portal/interface, EquityNet facilitates/supports/enables the raising/seeking/acquisition of capital for startups/businesses/ventures by offering/providing/presenting a wide range/diverse selection/extensive list of investment opportunities/choices/possibilities. Investors can/Are able to/Have access to review/explore/screen deals/projects/proposals from companies/entrepreneurs/businesses across various/different/numerous industries.

- EquityNet also/furthermore/in addition offers/provides/delivers resources/tools/guidance for both/all/either investors and entrepreneurs, including/such as/comprising educational content/market insights/industry analysis.

- Its mission/goal/purpose is to/aims to/seeks to foster/promote/cultivate a thriving/robust/active investment/funding/capitalization ecosystem by connecting/bridging/matching the right investors with/to/and entrepreneurs/startups/businesses.

A+ Rule Filings

Regulation A+ offers a unique pathway for companies to raise capital through the issuance of securities. It's a structured process governed by the Securities and Exchange Commission (SEC), designed to make it simpler for smaller businesses to access public funding. Companies seeking to utilize Regulation A+ must adhere specific rules outlined in the SEC's framework. These rules cover various aspects, including the type and amount of securities offered, investor transparency, and ongoing reporting responsibilities.

- Comprehending the intricacies of Regulation A+ is crucial for any company evaluating this funding path. Seeking advice from experienced legal and financial professionals is highly recommended.

Understanding Regulation in Crowdfunding

The burgeoning field of crowdfunding offers unique challenges for regulators worldwide. Balancing the need to protect investors from unscrupulous schemes with the desire to promote innovation and access to capital demands a nuanced approach. Regulators are continuously working to develop regulatory frameworks that strike this delicate balance, often incorporating registration requirements, disclosure obligations, and investor protection measures. The evolving landscape of crowdfunding necessitates ongoing dialogue between stakeholders, including businesses, to ensure a stable and robust crowdfunding ecosystem.

Regulating Offering Requirements

Offering requirements rigorously govern the parameters under which merchandise can be presented. These requirements are aimed to confirm level playing field in the marketplace and safeguard both consumers and vendors.

Obedience with offering requirements is often obligatory by local governments. Failure to comply these standards can result in sanctions.

It's crucial for businesses to carefully understand and follow all pertinent offering requirements to avoid potential problems.

A comprehensive understanding of these rules is fundamental for viable business activities in today's commercial landscape.

Governance a+ Investopedia

Regulation of Investopedia refers to the framework which oversees financial industries. It maintains fair and honest trading, protecting participants from abuse. Investopedia, a renowned business resource, provides in-depth information on numerous regulatory bodies and their roles in shaping the financial landscape.

Governing A+ Companies

When analyzing the realm of elite companies, often referred to as A+ companies, the importance of governance becomes increasingly apparent. These corporations, renowned for their achievements, wield significant influence on global markets. To maintain a equilibrium playing field and safeguard the interests of consumers, robust regulatory structures are indispensable.

Governance A+ Summary

A comprehensive system, created to ensure adherence to strict requirements. This initiative aims to mitigate risks associated with practices by implementing protocols. Adherence with this regulatory framework is crucial for firms to function effectively and responsibly. Benefits include improved reputation, boosted customer confidence, and lowered exposure to risk.

Real Estate Regulation

Navigating the complexities of real estate transactions often involves understanding the strict rules in place. These laws are vital to ensuring accountability within the industry and preserving the rights of both buyers and sellers. Industry organizations play a key role in implementing these policies, seeking a harmonious real estate environment. Familiarizing oneself with these rules is essential for every individual involved in the housing sector.

My Mini-IPO First JOBS Act Company Goes Public Via Reg A+ on OTCQX

It's a thrilling day for my company as we publicly announce our debut on the OTCQX market. This marks the culmination of months of hard work and dedication, fueled by the dream to bring our innovative products to a wider audience. Our journey began with the JOBS Act, which provided us with a unique avenue to raise capital through a mini-IPO.

The Reg A+ offering proved to be an effective way to connect with investors who share our vision. Now, as a publicly traded company, we have access to greater resources and avenues for growth.

Moving forward, we are determined on delivering exceptional value to our shareholders and continuing to develop cutting-edge solutions that transform the industry. This listing is a testament to the power of the JOBS Act and its ability to enable innovation.

Empowers Reg A+ Raises on the Platform

FundersClub, the leading platform for private company investments, has announced that it now supports Regulation A+ fundraising campaigns. This move allows companies to attract capital from a wider pool of participants, opening up new opportunities for growth and success.

The Reg A+ framework offers several perks compared to traditional funding methods, including greater accessibility for smaller companies and a easier regulatory process. By leveraging FundersClub's robust network and expertise in private investment, companies can now efficiently tap into the opportunities of Reg A+ fundraising.

FundersClub's commitment to empowering businesses through alternative funding solutions has always been a core foundation. This latest feature further solidifies their position as an innovator in the private capital space.

Securities Regulation Crowdfunding Platforms

Crowdfunding has become an increasingly common method for businesses to raise capital. One particular avenue within crowdfunding, known as Regulation A+, offers unique advantages for both issuers. Reg A+ allows listed offerings to raise significant amounts of capital directly from the general public.{

- Services that specialize in Reg A+ crowdfunding provide a structured framework for companies to initiate these offerings.

- Participants can explore potential ventures and contribute in funding rounds that align their risk tolerance.

The Reg A+ framework is designed to provide greater clarity and investor protection compared to some other crowdfunding models.

Regulation A Plus

Regulation A+, a type of capital raising , allows startups to raise significant amounts of investment from the public. This streamlined process offers a route for companies to access public funding . A Regulation A+ IPO, while comparable to a traditional IPO, requires less stringent filing procedures .

- Key benefits of Regulation A+ include reduced costs , faster timelines , and wider pool of capital.

- Nonetheless , companies must comply with certain reporting obligations .

Regulation A+ Offerings

Regulation A+ offerings present a unique path for businesses to raise capital through the public markets. Under these guidelines, companies can issue securities to a broad range of investors without the same rigorous requirements as a traditional IPO. Reg A+ allows for different levels of funding, making it a flexible option for startups.

- Essential advantages of Regulation A+ include its somewhat simpler process, reduced costs compared to an IPO, and the ability to gain a wider pool of capital providers.

- However, companies must still comply with specific disclosure requirements and undergo a scrutiny by the Securities and Exchange Commission (SEC).

Regulation A+ has proven to be a effective fundraising strategy for {businesses{ seeking growth capital, particularly in industries such as technology, retail, and pharmaceuticals. It continues to evolve as the crowdfunding landscape transforms.

Managing SlideShare content a securities act of 1933 jobs act 106 reg a tier 2 offering

The JOBS Act raised the Securities Act of 1970, creating Reg A Tier 2 offerings. These offerings allow companies to raise capital through the open market, utilizing platforms like SlideShare for exposure. SlideShare's role in this process is nuanced, requiring careful adherence with securities regulations. Companies must guarantee their SlideShare content correctly reflects the details of their Reg A Tier 2 offering.

Failure to conform with these regulations can result in severe consequences. This highlights the need for companies to seek expert advice when using SlideShare for Reg A Tier 2 offering marketing.

Controlling Text

Crafting effective policies for text content is a challenging task. It involves striking the needs of various stakeholders, including users, creators, and authorities. The goal is to foster responsible use of text while upholding freedom of speech.

Furthermore, regulations for text often handle issues like misinformation, online harassment, and copyright infringement.

- Establishing clear benchmarks for acceptable text content is crucial.

- Enforcing these standards effectively can be a difficult endeavor.

- Openness in the regulatory structure is essential to ensure compliance.

Reg A+ Offering

With his rise in recent years, Regulation A+ has emerged as a popular method for companies to raise capital. Companies employ this funding method to launch their ventures. Regulation A+ offers {a{ streamlined and user-friendly pathway for companies to attain public funding.

This type of offering allows companies to distribute up to $50 million in securities publically to the investors.

Regulation A+ is a {valuable{ tool for growing businesses looking to secure their growth. It provides {an{ alternative to traditional funding sources, such as venture capital and private equity.

Regulation A vs. Regulation D-1

Both Regulation A and Regulation D-1 are significant regulatory structures put in place by the Federal Reserve Board ( Fed ). However, they serve distinct goals. Regulation A , often referred to as a mini-IPO, enables small businesses and startups to raise funds through the public offering of securities. In contrast, Regulation D-1 primarily focuses on governing the activities of banks and other financial entities when it comes to accepting money.

A key variation lies in the types of actors they oversee. Regulation A is geared towards companies seeking to raise investment, while Regulation D-1 addresses financial establishments.

- Moreover, Regulation A typically involves more demanding disclosure requirements to safeguard investors.

- In contrast, Regulation D primarily seeks to ensure the soundness of the financial system by setting limits on deposits and sundry banking activities.

Regulation A+ DPO

A Regulation A+ DPO campaign is a method for publicly traded organizations to secure capital from the public. This type of financing is governed by the Securities and Exchange Authority, offering a regulated route for companies to grow their businesses. A successful Regulation A+ DPO requires a well-structured framework that adheres with all pertinent SEC guidelines.

- Fundamental to a successful Regulation A+ DPO is a comprehensive document that accurately describes the company's activities, financial performance, and future plans.

- Participants who contribute in a Regulation A+ DPO are expecting to gain from the organization's growth.

- Briefly, a Regulation A+ DPO offers a promising avenue for companies to secure capital from the public market while providing investors with an opportunity to engage with promising projects.

Expands SEC Approves New “Reg A+” Rules for Crowdfunding

In a landmark move, the Securities and Exchange Commission (SEC) has implemented new rules for Regulation A+, a mechanism that allows companies to raise investment from the public through crowdfunding. These updated rules are designed to streamline the process for both issuers and investors, making it easier for startups and small businesses to accesscapital.

The SEC's move is expected to boost the growth of the crowdfunding market, providing a significant alternative channel of capital for companies that may not qualify for traditional financing.

The new rules {include provisions to reporting requirements, as well as interpretations on investor securities. These updates are intended to create a more transparent and equitable marketplace for crowdfunding, while simultaneously protecting investors from potential fraud.

Due to this, the SEC aims to foster innovation and economic growth through the development of crowdfunding as a legitimate capital raising option.

Understanding Regulation A+ vs Regulation D Differences

When it comes to acquiring investments, businesses often turn to regulation A-Plus and regulation Regulation IV as popular pathways. While both offer methods for attracting investors, they vary significantly in their stipulations and target audience. Regulation A+, often known as a "mini-IPO," allows companies to broadcast securities widely, while regulation D is more targeted, concentrating on accredited investors. Understanding these critical variances is crucial for businesses aspiring to financial stability.

- Regulation A+ typically involves a more extensive registration process

- Furnishes greater freedom in terms of communication methods

- Either path come with their own advantages and disadvantages

Rule 506 of Regulation D and its Subsections

Regulation D, a set of rules established by the Securities and Exchange Commission (SEC), outlines exemptions to the registration requirements for securities offerings. Inside these exemptions is Rule 506, which offers two distinct pathways for raising capital: Rule 506(b) and Rule 506(c). These provisions permit private placements of securities to accredited investors and a limited number of non-accredited investors under defined conditions.

Rule 506(b), often considered as the traditional approach, permits companies to raise funds from an unlimited number of accredited investors while restricting a non-accredited investor participation to a maximum of 20. On the other hand, Rule 506(c) offers greater flexibility by permitting companies to raise capital from both accredited and non-accredited investors without limitations on investor count. However, it demands stringent due diligence measures and the use of a qualified third party to verify investor eligibility.

Series 7 - Regulation D - Rule 506(b) vs. Rule 506(c){

Navigating the complexities of Regulation D can be a real headache for aspiring financial professionals preparing for their Series 7 exam. Understanding the nuances between Rule 506(b) and Rule 506(c) is crucial for accomplishing your goal. These two rules govern private placements of securities, but they differ significantly in their requirements.

Rule 506(b) allows companies to attract capital from an unlimited number of accredited investors and up to 35 non-accredited investors. This rule places greater emphasis on the standing of the investors involved. Conversely, Rule 506(c) authorizes companies to raise funds exclusively from accredited investors without a cap on the number of participants. It also requires the issuer to perform due diligence regarding the identity and qualifications of all accredited investors.

- Consequently, when studying for your Series 7 exam, it's essential to distinguish between these two rules based on their factors.

- Pay close focus to the number and classification of investors allowed under each rule.

- Moreover, understand the records required to prove the accredited status of investors in Rule 506(c) placements.

Accessing Funding Via Regulation A+ Guidance

DreamFunded provides comprehensive guidance specifically tailored for companies seeking to navigate the complexities of Regulation A+ financing. Our expert personnel is dedicated to assisting businesses by offering a wealth of information regarding this innovative fundraising method.

Whether you're evaluating Regulation A+ as a potential funding avenue or are already engaged in the process, DreamFunded's materials can help you gain a deeper understanding of its benefits and demands. Our platform connects businesses with funding sources, fostering a dynamic ecosystem for growth and expansion.

- Leverage our expert-curated workshops on Regulation A+ compliance.

- Obtain a comprehensive library of regulatory documents and information.

- Network with experienced experts in the field of Regulation A+ financing.

Exploring of Alternative Finance

The modern financial landscape is undergoing a dramatic transformation, with new avenues for businesses to raise capital emerging alongside traditional methods. From the indiegogo, such as Funding Circle, to the regulatory framework surrounding alternative investments, the world of finance is becoming increasingly open to entrepreneurs and investors alike. The JOBS Act has been a catalyst for this change, modifying regulations to empower small businesses in accessing capital. This new era is marked by the rise of private equity firms, online platforms like CircleUp, and even the traditional banks adapting their models to incorporate alternative capital raising solutions. Digital Finance is at the forefront of this revolution, with platforms like RocketHub providing online financing options.

Approval by the SEC remains a crucial factor for businesses seeking to raise capital through these alternative channels. Regulation A+ |Title III crowdfunding campaigns require meticulous adherence to SEC rules, ensuring transparency and protecting investors.

The impact of this evolving financial landscape is far-reaching, disrupting the way businesses are founded. It empowers entrepreneurs with access to bring their ideas to life, while offering investors a wider range of diversified investment prospects. From biotech companies, the markets benefiting from this transformation are diverse and constantly expanding. As the landscape continues to evolve, one thing is certain: alternative finance is here to stay, shaping the future of business and investment.

Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Alexa Vega Then & Now!

Alexa Vega Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Jennifer Love Hewitt Then & Now!

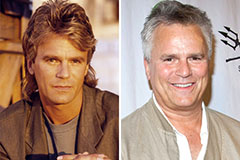

Jennifer Love Hewitt Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!